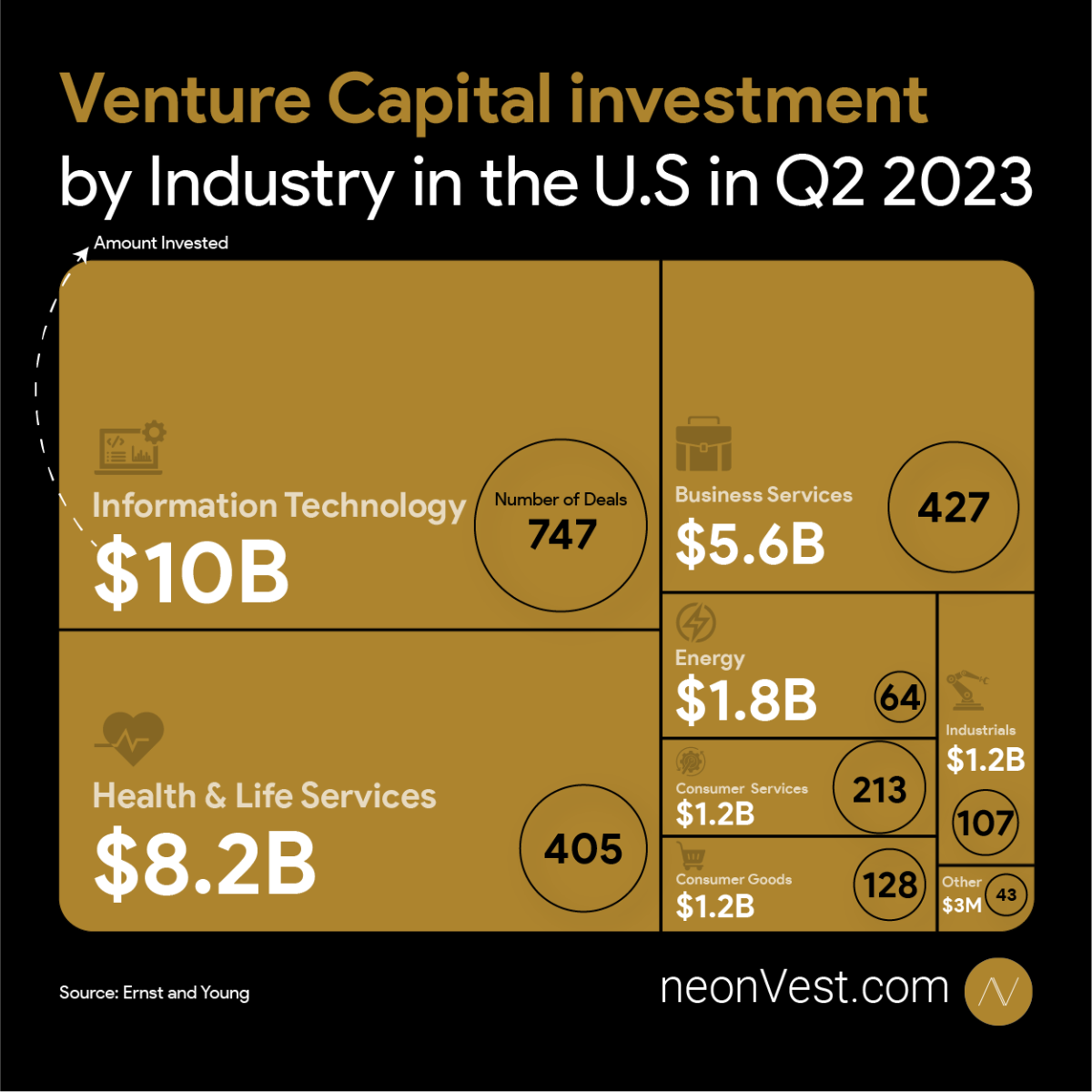

The venture capital (VC) landscape in Q2 2023 showcased a total investment of $29.4 billion, marking a decline from the $44.4 billion amassed in the previous quarter. This decline of 34% signals the impact of economic uncertainties and a dip in IPO activities, reflecting a cautious approach in the investor community. Amidst this backdrop, the distribution of funds across various sectors presents a glimpse into the strategic focus of investors.

Information Technology: $10 Billion

The Information Technology (IT) sector led the way in VC funding, securing $10 billion. This sector continues to be a magnet for funding, driven by the relentless demand for digital innovation. As organizations constantly evolve to meet the digital era, the IT sector stands as a cornerstone for tech-driven solutions and advancements.

Health & Life Services: $8.2 Billion

Following closely was the Health & Life Services sector with a VC injection of $8.2 billion. This substantial investment underscores the ongoing emphasis on healthcare innovation, particularly in a world still grappling with the aftermath of a global health crisis. The funds are pivotal in advancing healthcare solutions, thus contributing to better patient care and medical breakthroughs.

Business Services: $5.6 Billion

The Business Services sector bagged $5.6 billion in VC funding, reflecting the ongoing need for services that drive operational efficiencies and competitive advantages in a challenging business environment. Amidst complex market dynamics, the investment in this sector is a testament to the continuous search for innovative business solutions.

Energy: $1.8 Billion

The Energy sector garnered $1.8 billion in VC funds, showcasing a cautious yet notable interest from investors. With the rising global energy demands and a concerted push towards sustainable energy solutions, this funding highlights the sector’s potential in driving a greener energy paradigm.

Consumer Services: $1.2 Billion

Consumer Services sector received $1.2 billion in VC funding, indicating the evolving consumer preferences and the continual quest for innovative services that align with market trends and consumer expectations.

Consumer Goods: $1.2 Billion

Similarly, the Consumer Goods sector also attracted $1.2 billion, reflecting a sustained interest in developing products that resonate with the changing consumer demands and market trends.

Industrials: $1.2 Billion

The Industrials sector, with a VC investment of $1.2 billion, underscores its crucial role in bolstering economic infrastructures and advancing industrial innovation. Despite the modest investment, the sector holds promise as a cornerstone for economic revival and sustainable growth.

The high investment in Information Technology and Health & Life Services sectors highlights the value placed on digital innovation and healthcare resilience in today’s world. On the flip side, the modest funding in sectors like Energy and Industrials shows a more cautious approach, possibly awaiting better market conditions or clearer regulatory settings.

The decline in total VC investment from the previous quarter indicates a shift in investor strategy due to economic uncertainties. However, the significant funding in certain sectors suggests a focus on sustainable growth and innovation. It’s about investing in sectors that not only promise good returns but also hold the potential to drive economic recovery and address societal challenges.