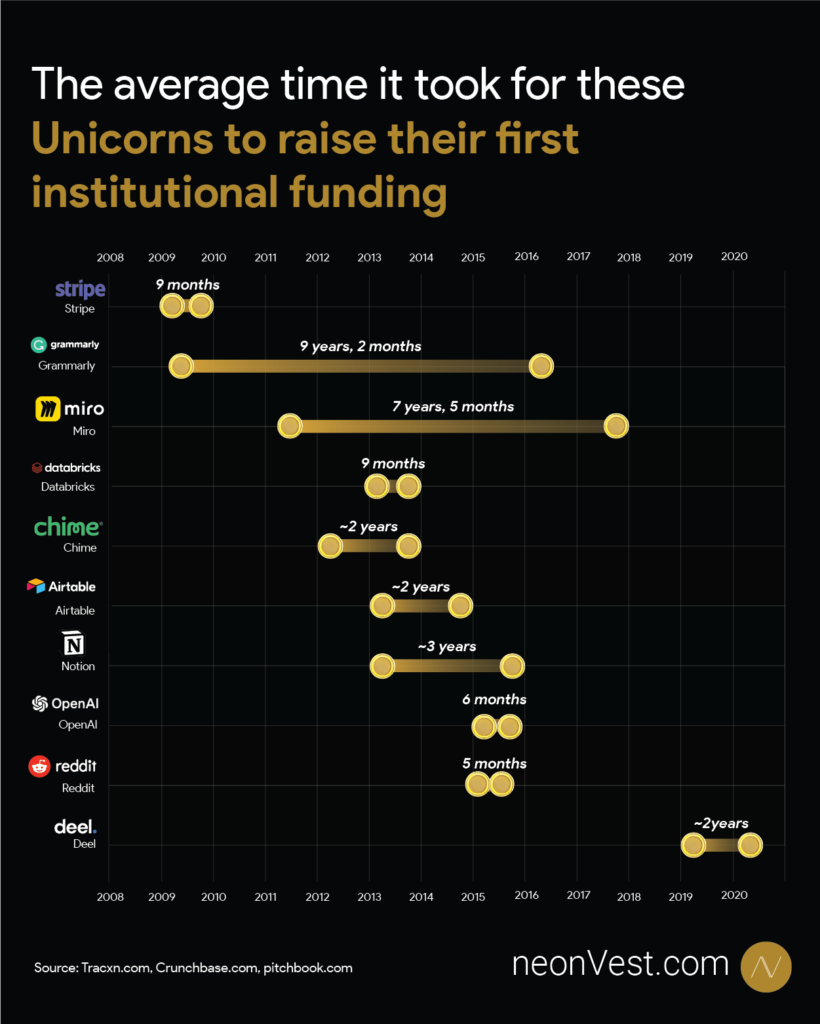

Securing institutional funding is a critical milestone that often serves as a springboard for further growth and valuation ascents. Among the echelons of startups, a select group distinguishes itself by achieving unicorn status—a valuation of $1 billion or more. The pace at which these startups secure their first institutional funding varies significantly, mirroring the diverse landscapes and challenges inherent in their respective domains. Raising money is no easy task, so today we are looking at ten unicorn startups, shedding light on their journeys from inception to their first institutional funding.

- Stripe

- A mere 9 months post-inception, Stripe raised its first institutional funding, embodying the rapid pace at which fintech startups can galvanize investor interest. Revolutionizing online payments with its seamless APIs, Stripe quickly magnetized investors, embodying fintech’s allure.

- Sector: Fintech

- Headquarters: San Francisco, California

- Total Funding to Date: Over $2 billion

- Grammarly

- In a stark contrast, Grammarly’s journey to institutional funding spanned 9 years and 2 months, reflecting the long-term persistence sometimes required in edtech ventures. Despite a protracted path to institutional funding, Grammarly’s AI-driven writing assistant has become indispensable for millions.

- Sector: EdTech

- Headquarters: San Francisco, California

- Miro

- With a timeline of 7 years and 5 months, Miro’s route to funding underscores the evolving recognition of collaborative digital workspace platforms. Miro’s collaborative whiteboard platform gradually won over investors, mirroring the rising esteem for digital workspace solutions.

- Sector: Collaboration Software

- Headquarters: San Francisco, California

- Total Funding to Date: $476.3 million

- Databricks

- Echoing the urgency often seen in data analytics ventures, Databricks secured its institutional funding just 9 months post-inception. Databricks’ swift move to secure funding underscores the urgent investor interest in advanced analytics and AI solutions.

- Sector: Data Analytics

- Headquarters: San Francisco, California

- Chime

- The fintech sector’s allure is again showcased by Chime’s 2-year journey to institutional funding, emphasizing the investor magnetism of disruptive banking solutions. Chime’s disruptive online banking solutions steadily drew investor attention, spotlighting fintech’s potential.

- Sector: Fintech

- Headquarters: San Francisco, California

- Airtable

- Within 2 years, Airtable attracted institutional backing, underscoring the growing investor appetite for collaborative, flexible database platforms. Airtable’s flexible, collaborative database platform quickly resonated with investors, highlighting the appetite for versatile productivity tools.

- Sector: Software

- Headquarters: San Francisco, California

- Total Funding to Date: $1.4 billion

- Notion

- After 3 years of existence, Notion garnered institutional funding, reflecting a measured pace in securing support for innovative productivity solutions. Notion’s methodical pace towards funding reflects a growing investor recognition of innovative productivity platforms.

- Sector: Productivity Software

- Headquarters: San Francisco, California

- OpenAI

- The brisk 6-month timeframe to funding for OpenAI underscores the critical importance and investor enthusiasm surrounding artificial intelligence research. The brisk stride to funding for OpenAI underscores the paramount importance and investor exuberance surrounding AI research.

- Sector: Artificial Intelligence

- Headquarters: San Francisco, California

- Reddit

- A 5-month journey to funding accentuates Reddit’s early appeal as a novel social media platform, resonating with the investor community. Reddit’s early appeal as a burgeoning social media platform swiftly captivated the investor community.

- Sector: Social Media

- Headquarters: San Francisco, California

- Total Funding to Date: $1.3 billion

- Deel

- In the competitive realm of fintech, Deel’s 2-year pathway to institutional funding showcases the steady investor interest in payment and payroll solutions. Deel’s journey underscores the steady investor interest in innovative payment and payroll solutions, a testament to fintech’s expansive potential.

- Sector: Fintech

- Headquarters: San Francisco, California

The stories of these unicorn startups show a wide range of timelines to get institutional funding. Each company faced different challenges and opportunities in their sectors. While some got funding fast, others took a longer time. Despite the different paths, they all reached the unicorn status, which is a big achievement. These stories provide valuable lessons for new entrepreneurs and investors.

Getting institutional funding is a big step for startups, and neonVest can help make this process faster and smoother. neonVest has a unique approach where they match founders with Superchargers. These Superchargers are top-level Venture Capital executives or successful founders and operators who have a lot of experience. They can provide the funding startups need, and also offer valuable advice and connections that can help the founders grow and succeed.

By connecting startups with the right investors and mentors, neonVest creates a supportive environment for startups. This support can help them get the funding they need quicker so they can focus on growing their business. The success stories of the unicorns mentioned earlier, along with the support from platforms like neonVest, highlight a positive outlook for new startups in today’s funding environment.