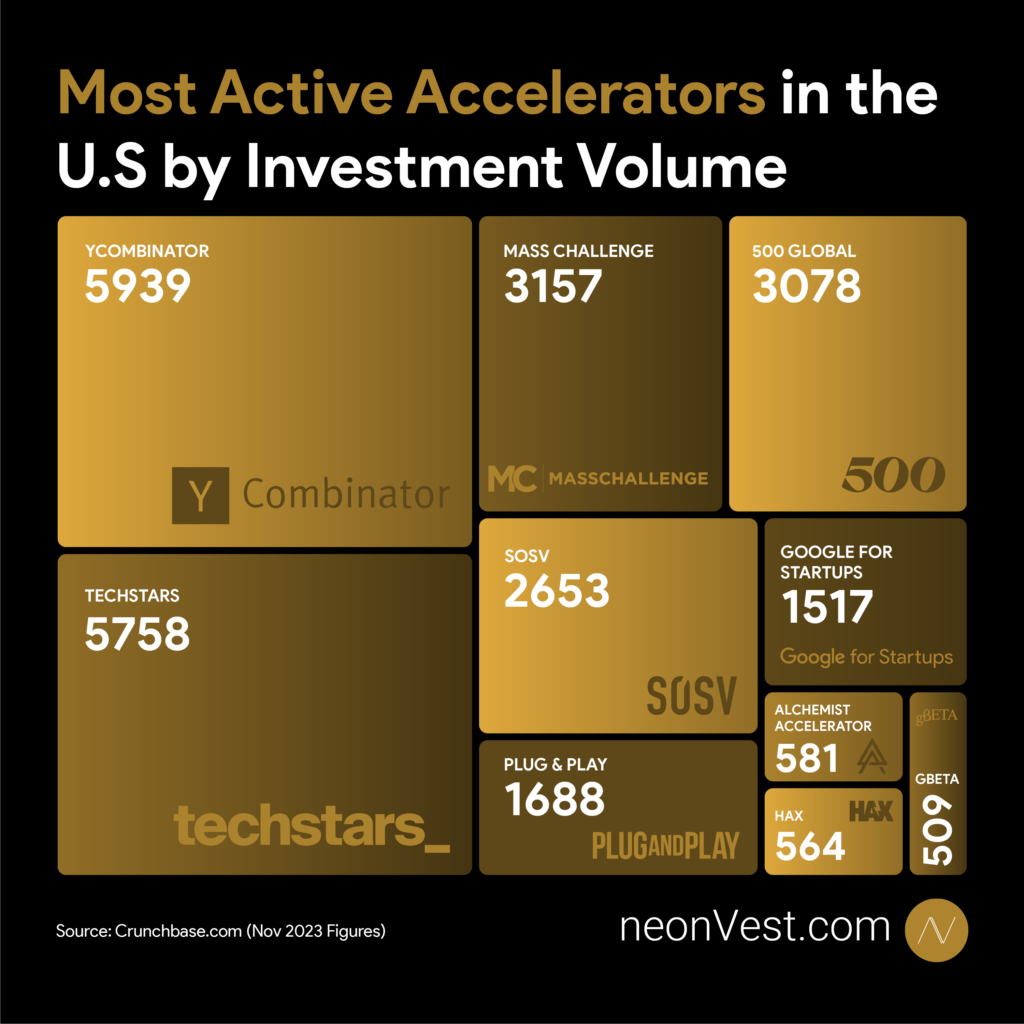

Accelerators have played a crucial role in shaping the future of emerging companies. They not only provide essential funding but also mentorship, resources, and networking opportunities that are vital for growth. When it comes to supporting startups, accelerators are often the first thought.

However, not every startup gets the opportunity to be part of these elite programs. The challenges of securing a spot in top accelerators underscore the need for alternative pathways to success. For many founders, navigating the journey of startup growth requires innovative approaches beyond traditional accelerator models. Here are the top 10 most active accelerators in the United States, ranked by the number of investments they have made:

1. Y Combinator

Leading the pack is Y Combinator, renowned for its influential role in the startup ecosystem. With a staggering 5,939 investments and 535 exits, Y Combinator has been a launchpad for some of the most successful startups, including Dropbox, Airbnb, and Stripe. Its twice-a-year program culminates in Demo Day, where startups pitch to a selected audience of investors.

2. Techstars

Close behind is Techstars, with 5,758 investments and 457 exits. Known for its mentorship-driven accelerator programs, Techstars has a global presence and supports startups across various sectors. Techstars’ alumni include notable companies like ClassPass and SendGrid, demonstrating its impact across diverse industries.

Mass Challenge stands out with 3,157 investments and 193 exits. Unlike other accelerators, it operates as a non-profit and takes no equity from the startups it supports. Mass Challenge focuses on high-impact, early-stage startups and has a broad industry reach.

4. 500 Global

Formerly known as 500 Startups, 500 Global has made 3,078 investments with 367 exits. This accelerator is known for its global footprint and diverse investment portfolio, supporting startups in over 75 countries. Its notable investments include Credit Karma and Canva.

5. SOSV

SOSV has carved its niche with 2,653 investments and 73 exits. This accelerator focuses on deep tech and hardware startups, offering specialized programs like HAX for hardware and IndieBio for biotech.

Plug and Play has 1,688 investments and 161 exits to its name. Known for its industry-specific accelerator programs, it connects startups with large corporations, providing a unique platform for growth and collaboration. Plug and Play’s success stories include PayPal and Dropbox.

Google for Startups has made a significant impact with 1,517 investments and 61 exits. As part of the tech giant’s effort to support the startup community, it offers access to Google’s resources, expertise, and global network, aiding startups in scaling their technology and business.

Alchemist Accelerator, with 581 investments and 54 exits, is focused on enterprise software startups. It distinguishes itself by concentrating on teams with a strong technical foundation, aiming to transform them into successful business ventures.

9. HAX

A branch of SOSV, HAX, with 564 investments and 13 exits, specializes in hardware startups. Based in Shenzhen and San Francisco, HAX provides an ideal platform for hardware startups to access manufacturing resources and scale their products.

10. gBeta

Rounding out the top ten is gBeta, with 509 investments and 11 exits. Part of the Gener8tor platform, gBeta is a free accelerator for early-stage companies. It’s unique for not taking equity and for its focus on startups in smaller metropolitan areas.

These accelerators have played a pivotal role in the startup ecosystem, providing more than just funding. They offer mentorship, resources, and networking opportunities, all of which are crucial in transforming early-stage startups into successful businesses. The impact of these accelerators is evident in the number of successful exits, underscoring their importance in the growth and success of startups across various industries.

Securing a place in such prestigious accelerators is a rigorous and highly selective process, which may not be feasible for every startup. This is where neonVest offers a unique solution.

As a platform, neonVest specializes in connecting startups directly with investors and operators for advice, referrals, and funding. With over $250 million raised by its users, including from notable sources like Y Combinator and TechStars, neonVest demonstrates its effectiveness in bridging the capital access gap.

This approach offers startups a viable alternative to traditional accelerators, allowing them to retain more equity and control while still accessing crucial resources and networks. For startups facing the daunting challenge of growth and scaling, neonVest emerges as a practical and empowering tool, simplifying the journey to successful funding without the constraints of an accelerator program.