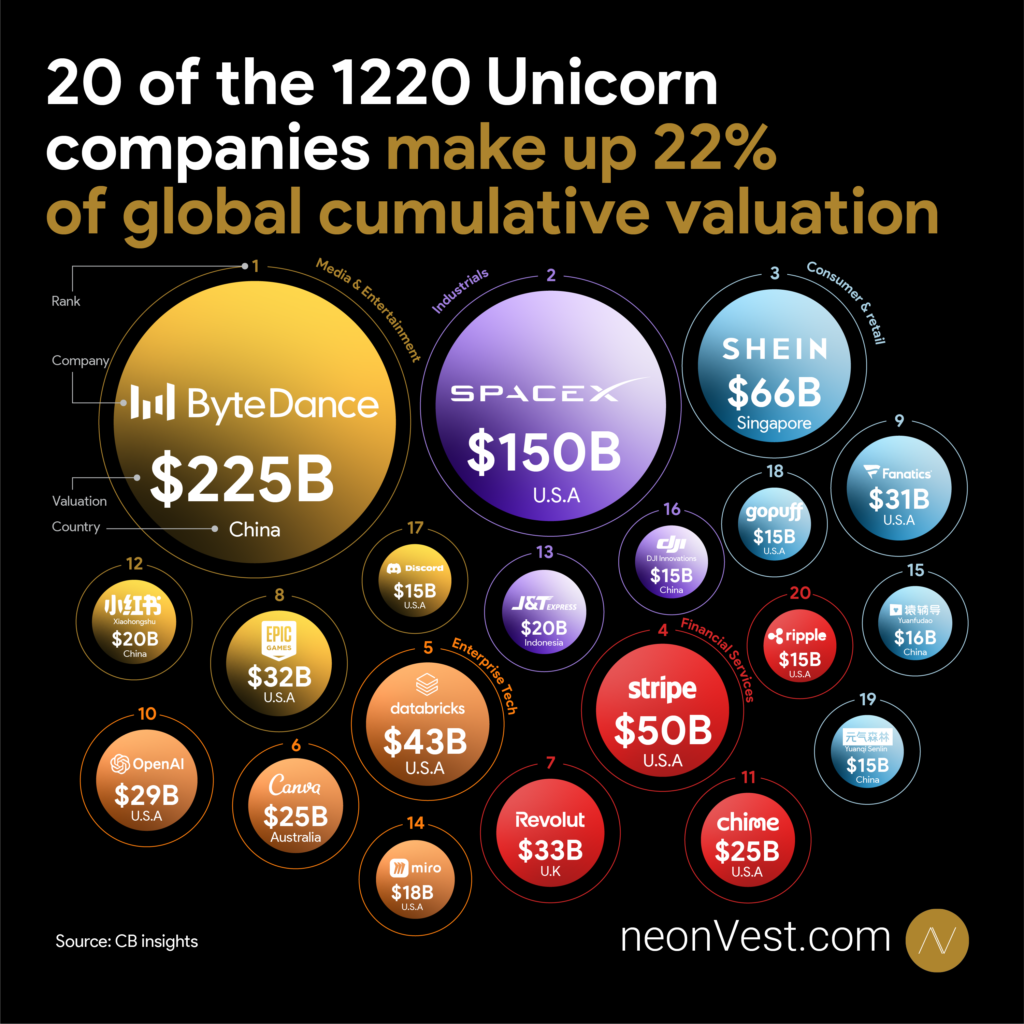

The term “unicorn” has become a buzzword in the startup ecosystem, referring to privately held startups valued at over $1 billion. As of Q2 2023, there are approximately 1220 unicorn companies globally, but a staggering 22% of the cumulative valuation is attributed to just 20 of these companies. This article takes a closer look at these top-tier unicorns, exploring their valuation, country of origin, industry, and key investors.

• At the pinnacle of this list is ByteDance, the Chinese media and entertainment powerhouse, known widely for its app TikTok. With a valuation of $225 billion, ByteDance stands as a testament to the explosive growth potential of social media platforms. Key investors include Sequoia Capital China and SoftBank Group, who have backed the company’s ascent to the top.

• Trailing not far behind is SpaceX, Elon Musk’s ambitious aerospace manufacturer and space transport services company, valued at $150 billion. It has been in the unicorn ranks since 2012 and has the backing of investment giants such as Founders Fund and Draper Fisher Jurvetson. SpaceX’s growing valuation reflects the increasing commercial and strategic importance of space exploration and transport.

• Singapore-based SHEIN, which has revolutionized the fast fashion industry with a valuation of $66 billion, joined the unicorn list in 2018. It’s supported by investors like Tiger Global Management and has made its mark with a unique approach to consumer retail, combining aggressive online marketing with a fast supply chain.

• Stripe, the American financial services and software as a service (SaaS) company, boasts a $50 billion valuation. Since 2014, its growth has been fueled by a vision to simplify online payment processing, and it’s backed by venture firms like Khosla Ventures.

• Databricks, an enterprise tech company specializing in big data and artificial intelligence, has secured a valuation of $43 billion. It’s supported by heavyweight investors such as Andreessen Horowitz and has been a part of the unicorn scene since 2019.

• Canva, the Australian graphic design platform, became a unicorn in 2018 and now sits at a $25.4 billion valuation. Its user-friendly design software has democratized graphic design, earning the trust and dollars of Sequoia Capital China and Blackbird Ventures.

• The UK’s fintech star, Revolut, with a valuation of $33 billion, has redefined personal finance since becoming a unicorn in 2018. Its investors include Index Ventures and DST Global, supporting its mission to revolutionize banking.

• Epic Games, the creator behind the global phenomenon Fortnite, is valued at $31.5 billion. Since becoming a unicorn in 2018, its valuation has been underpinned by investments from Tencent Holdings and KKR.

• Fanatics, a leader in licensed sports merchandise, is valued at $31 billion. It became a unicorn in 2012 and since then has been backed by SoftBank Group and Andreessen Horowitz, showcasing the profitability of sports fandom.

• OpenAI, known for its significant contributions to artificial intelligence, holds a valuation of $29 billion. With the support of Khosla Ventures, it joined the unicorn club in 2019 and continues to push the boundaries of AI research and application.

• Chime, a fintech company that aims to make banking services more accessible, is valued at $25 billion. It became a unicorn in 2019 and has been supported by Forerunner Ventures and Crosslink Capital.

• Xiaohongshu, a social media and e-commerce platform based in China, has a valuation of $20 billion. It became a unicorn in 2016 and is backed by GGV Capital and Tencent, reflecting the growing influence of social commerce.

• Indonesia’s J&T Express, with its innovative logistics solutions, has quickly reached a valuation of $20 billion. It achieved unicorn status in 2021 with the support of investors like Hillhouse Capital Management.

• Miro, an enterprise tech unicorn from the United States, is valued at $17.5 billion, attracting investments from Accel and AltaIR Capital since it became a unicorn in 2022.

• Yuanfudao, a Chinese online education platform, has a valuation of $15.5 billion. Since joining the unicorn ranks in 2017, it has been transforming education with the help of Tencent Holdings and Warbug Pincus.

• DJI Innovations, the leading drone manufacturer from China, holds a valuation of $15 billion. It became a unicorn in 2015, with Accel Partners and Sequoia Capital investing in its vision.

• Discord, the communication platform favored by gamers, has a valuation of $15 billion. It achieved unicorn status in 2018 with investments from Benchmark and Greylock Partners.

• Gopuff, a U.S.-based instant delivery service, also holds a $15 billion valuation. It became a unicorn in 2020, redefining convenience with the help of Accel and SoftBank Group.

• Yuanqi Senlin, a Chinese beverage startup known for its healthy drinks, has reached a valuation of $15 billion. It’s been on the unicorn list since 2020, drawing significant interest and investment from Sequoia Capital China and Gaorong Capital. The brand’s rapid rise reflects a growing consumer trend towards health-conscious products.

• Ripple, rounding out our list, is an American fintech firm challenging the conventional financial ecosystem with blockchain technology. Since becoming a unicorn in 2019, it has achieved a $15 billion valuation. Its growth is fueled by investments from firms like IDG Capital and Lightspeed Venture Partners, highlighting the potential of fintech innovations to transform the global financial services industry.

The remarkable scale of valuation held by these 20 unicorns demonstrates the immense potential for startups to ascend to global prominence. As these companies continue to reshape their respective industries, they serve as a beacon for emerging startups aiming for unicorn status.

This is where neonVest plays a pivotal role. As a platform designed to connect innovative startups with the right investors, neonVest can be instrumental in helping future unicorns to emerge and grow. It provides a curated environment where startups can find not just funding, but also strategic guidance to navigate the complexities of scaling a high-value business.

For investors, neonVest offers a window into the world of high-potential companies that could be the next ByteDance, SpaceX, or SHEIN. The platform’s ability to identify and match investors with startups that have unicorn potential is crucial in a market where early identification and timely investment can yield substantial returns.

In a market that is increasingly competitive and challenging, neonVest stands out by offering the insights, network, and tools necessary for startups to thrive and for investors to participate in transformative growth stories. Whether you’re on the brink of a breakthrough or seeking to back the next market leader, neonVest aims to be the partner that helps turn bold visions into valuation milestones.